35+ Simple interest mortgage calculator

Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then. This calculator will help you to determine the principal and interest breakdown on any given payment number.

1

This will be the only land contract calculator that you will ever need whether you want to calculate payments for.

. Interest is the compensation paid by the borrower to the lender for the use of money as a percent or an amount. This overpayment calculator does not include all of the information that you need to select or compare mortgages. Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest.

Brets mortgageloan amortization schedule calculator. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Therefore the initial interest rates are normally 05 to 2 lower than FRM with the same loan term.

We start with A which is your investment horizon or goal. The above calculations. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

Please note the calculator does not factor in any charges for early repayments of the total mortgage balance and is based on a capital repayment mortgage. Our mortgage calculator helps by showing what youll pay each month as well as the total cost over the lifetime of the mortgage depending on the deal. Then subtract the principal amount from that number to get your mortgage interest.

A mortgage is one of the biggest commitments youll make in your financial life. Calculate loan payment payoff time balloon interest rate even negative amortizations. But with so many possible deals out there it can be hard to work out which would cost you the least.

For other types of loans such as auto loans personal loans or student loans please use the simple mortgage calculator. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

This is a result of the time value of money principle since money today is worth more than money tomorrow. It is the interest rate expressed as a periodic rate multiplied by the number of compounding periods in a year. If applicable please enter the arrangement fee as a percentage this will then be added to the total mortgage facility.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. For example if youre paying 1250 dollars a month on a 15-year 180000 loan you would start by multiplying 1250 by 15 to get 225000. Other debt obligations like student loans and car payments are factored in when you apply for a loan but you should also consider your personal expenses such as groceries and entertainment when determining how much you want to spend.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. People typically move homes or refinance about every 5 to 7 years. If a person.

Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. To calculate mortgage interest start by multiplying your monthly payment by the total number of payments youll make. The lender charges interest as the cost to the borrower of well borrowing the money.

Like home improvements which can be expensive to pay for using any other form of financing that charges higher interest rates. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. The formula is shown.

Interest is easy to calculate. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Although it is easier to use online daily compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. There are two distinct methods of accumulating interest categorized into simple interest or compound interest. Most commercial mortgage facilities charge a lender arrangement fee also known as a facility fee acceptance fee or booking fee which is usually a percentage of the mortgage amount being borrowed and added to the facility.

Build home equity much faster. Mortgage interest rates are normally expressed in Annual Percentage Rate APR sometimes called nominal APR or effective APR. Almost any data field on this form may be calculated.

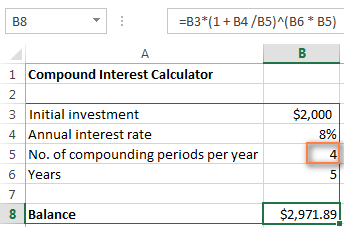

You simply take the interest rate per period and multiply it by the value of the loan outstanding. If you make multiple types of irregular. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

The concept of interest is the backbone behind most financial instruments in the world. The simple mortgage calculator requires only four options that are necessary for any type of loan and mortgage which are the loan amount interest rate loan terms and the starting date. Simple interest rate and maturity period are the key terms to generate the amortization schedule monthly payment and.

Simple Interest Loan Amortization Calculator is an online personal finance assessment tool which allows loan borrower to find out the best loan in the finance market. In other words the results of what you can achieve through the magic of. Mortgage rates tend to follow movements of the 10-year.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Please request a Mortgage Illustration before you choose a mortgage. 35 14901 1294 149655 36 149655 649 0.

Many experts recommend spending a maximum of 28 to 35 percent of your pre-tax income on your housing expenses.

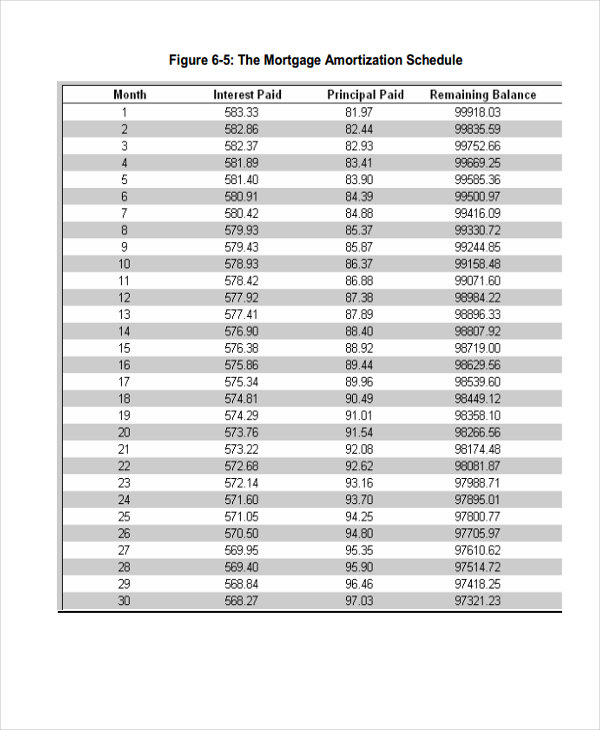

29 Amortization Schedule Templates Free Premium Templates

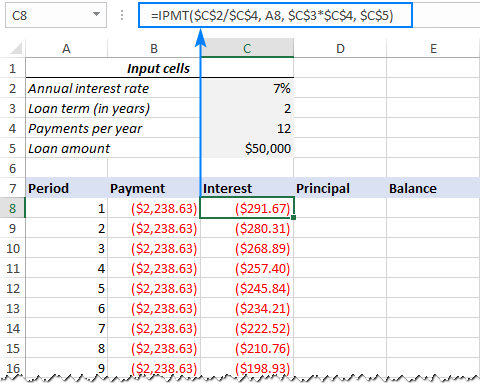

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

3

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Free Printable Debt Payoff Coloring Page Credit Card Debt Payoff Credit Card Tracker Credit Card Interest

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Investing

Interest Rates Mississauga Real Estate Mls

Compound Interest Formula And Calculator For Excel

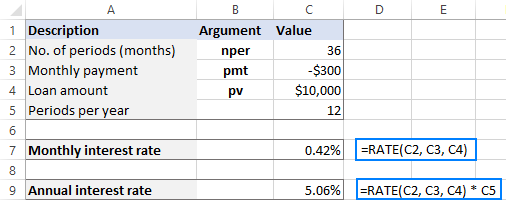

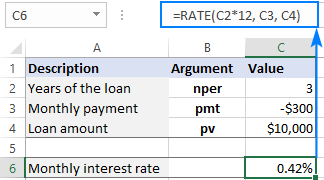

Using Rate Function In Excel To Calculate Interest Rate

Using Rate Function In Excel To Calculate Interest Rate

30 Practical Bike Storage Ideas For Small Apartments Bike Storage Solutions Indoor Bike Storage Bike Storage Apartment

Simple Loan Calculator Using Javascript Css

Amortization Table Real Estate Exam

1

35 Awesome Buddha Garden Design Ideas For Calm Living Freshouz Com Zen Garden Design Buddha Garden Zen Rock Garden

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So